Now a days lot of articles or news items have been floating around, and so are offline/online discussions happening that 'Television viewing in India has come down' or 'Audience is moving away from TV shows'. But has it really?? 😔Want to dwell upon, so started this topic which may interest many.

As I was coming across contradictory news items & discussions, thought to spend few minutes during my free time to read, understand and analyse as a common TV audience. So cross checked over last few weekends in my free time and found some interesting bits, that I'm sharing here. Shall keep adding data, info and posts. People reading, can also share their observations or relevant data, if any

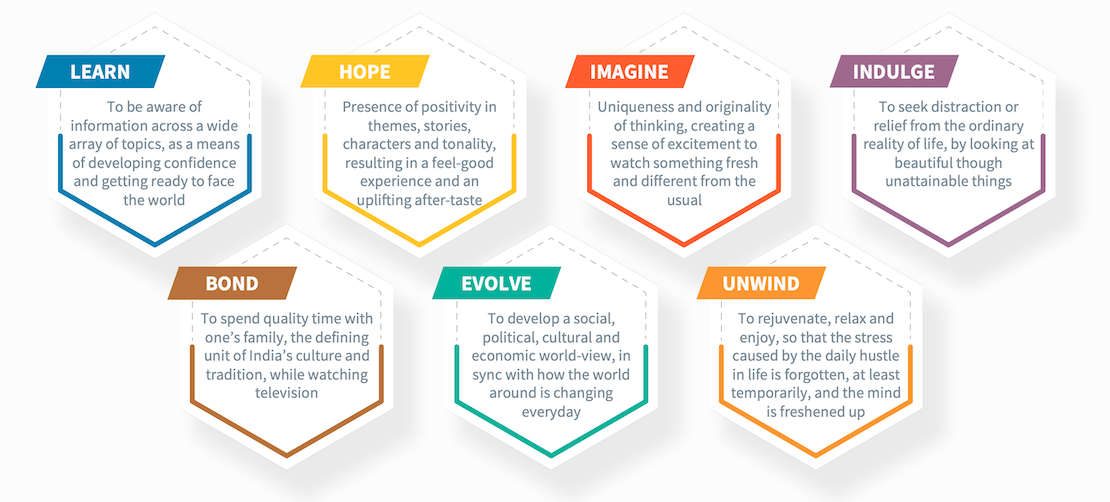

First thing First: Understanding audiences

Television audiences are more settled and expect a daily dose of their appointment based content viewing, primarily woven around families, or relatable characters, drama, emotions, fun, bonding and conflicts. Its a group that usually sits together, and watches TV shows than solos. Whereas, OTT audiences are more evolved and expect more experimental and disruptive stories, characters and plots as these shows can be watched in solos from any device any time.

Households owning TV sets in India:

A news report published in 2021 says 210 mn Indian households own TV sets. 👍🏼

According to the TV Universe Estimates (UEs), TV Homes in India increased by 6.9% to 210 million from previous 197 million in 2018. TV viewing Individuals grew by 6.7%, effectively an increase of 56 million, since the last study was conducted two years back.

The report adds that the growth of ownership of TV sets in rural India took over urban India, with rural TV markets growing at 9% compared to 4% in the urban markets.

In absolute terms, "there is an increase in TV households of nearly 3.2 Mn in Urban India and 10.3 Mn in Rural India. TV households grew in all town classes of Urban markets with mega cities growing by 6%. Hindi speaking markets grew by 8%, highest in the country ” the study points out.

So if there is an increase in TV sets usage, then how can TV consumption in India come down?